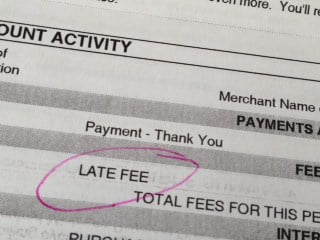

ADHD and money have a love hate relationship, don’t they! We love having money, yet hate managing it. Neglecting our finances may seem like the easy solution, but it causes problems. Late fees, overspending, fear, shame, and stress.

ADHD and money have a love hate relationship, don’t they! We love having money, yet hate managing it. Neglecting our finances may seem like the easy solution, but it causes problems. Late fees, overspending, fear, shame, and stress.

Claire is one of my private coaching clients. Since one of Claire’s big goals is to be debt-free, she’s accepted that she has to stop avoiding her finances.

No more sporadically paying her bills and stacking her bank statements on the floor. No more impulsive spending. Claire wants a better relationship between her money and her ADHD.

She’s making good progress towards her goal. In the months we’ve worked together, Claire has organized her financial papers. Her new, easy to use filing system helps.

She’s is also doing better control her impulsive spending.

Claire still has an ADHD money challenge, though. Paying her bills on time. She’s still not consistent enough with sticking to her bill paying routine.

Claire jokes that she thinks banks invented credit card late fees for ADHD adults. Claire’s joke is painfully close to the truth. I suspect adults with attention deficit do pay more than their share of credit card late fees.

Paying bills on time requires attention to details and routine follow-through. Having a hard time with both of those are key ADHD symptoms.

ADHD and Money. Two Steps To Avoiding Late Fees.

If you have ADHD and money challenges how can you avoid paying late fees?

I often hear automatic bill pay as the solution. But, many of my clients with ADHD and money problems resist automatic bill pay. If you don’t know how much you have in your bank account you risk hefty over-drafts fees.

That’s why I suggest a modified automatic payment to avoid ADHD credit card late fees.

Here’s how to avoid late fees…

-

Set up an auto payment to pay the minimum amount due on the credit card. You’ll be confident your bill will be paid on time and you’ll avoid a late fee.

-

Build a weekly routine for paying your bills. There are many options for this. Find a routine that works for you and your cash flow. Most of the time your routine will let you pay the bill on time. If you do forget at least you’ll have made the minimum payment and avoided the late fee.

I confess to having had my own woes with money. ADHD disorganization made a joke of my money management. I used to pay a lot of credit card late fees.

It was frustrating. Shame producing, too. Another flaw I hid from my family and friends. It was hard for me to take myself seriously when I couldn’t even pay the bills on time.

Creating my weekly bill paying routine was the start of turning around my relationship with money. Now it’s rare for a bill to be paid late. The last one was because I moved too fast and didn’t click the final VERIFY button. I’ve learned to slow down and pay more attention. Electronic banking has also made bill paying much easier.

Having a strong relationship between your ADHD and money is possible. If ADHD makes managing your finances a problem, I encourage you to stop ignoring it. Living successfully with ADHD doesn’t have to be so hard.

Want some other tips on how to manage the varied and unusual ways that ADHD costs you extra money?

Make sure you check out Episode 5: The ADHD Tax (and How to Pay Less of It!) of my new podcast – Kick Some ADHD! Click HERE to tune in.

Tired of struggling with ADHD? You’re in the right place. ADHD Success is loaded with free, practical tips to help you get organized, manage your time, and live more easily with Adult ADHD. Like what you read? Sign up for the newsletter now! No Spam. I promise!

Tired of struggling with ADHD? You’re in the right place. ADHD Success is loaded with free, practical tips to help you get organized, manage your time, and live more easily with Adult ADHD. Like what you read? Sign up for the newsletter now! No Spam. I promise!

Readers: One of my former clients sent me this email with his money system. Happy to share it with you all!

Dana, Saw your recent post on ADHD and money. I didn’t leave a post because I need to limit my social media presence because of the promotion I am up for and where I will be working. But if you want to add something feel free just keep my name off:

I have 3 accounts:

– Spending (this is money that I use for groceries, coffee, gas, eating out, etc).

– Savings (Savings Account)

– Bill Pay (This is where I pay all my bills out of automatically from my bank to the vendor and use the following rules)

1. Always have your bank send the payment, never allow a vendor to withdrawal funds. This way you maintain control.

2. Sign-up for level pay with all your utilities so that the payment amount is the same all year round.

3. Look at each of your monthly bills (let’s use $100 a month electrical bill) and multiply it by 1.1 (or 10%) and you get $110. Divide that by 2 and you get $55. Now set-up your automatic payments to pay $55 every two weeks (the payments should go out the Monday after you get paid).

4. Call all your credit card companies and ask them what the minimum payment would be if you maxed out your credit card. So If you you have a $10,000 limit but only have a $2,000 balance, you want to know how much the monthly payment would be if you had a $10,000 balance. Take the number they supplied you and do the same as you did in Step 3.

A couple of things happen here:

1. You have the same amount due every two weeks, it never changes.

2 You never miss a payment and get charged late fees.

3. Because your paying every two weeks and 10% extra you begin to build up a credit with each vendor, in about a year you’ll be 1 month ahead, so in 5 years you’ll be close to 6 months ahead. So if anything happens (ie you loose your job, you don’t need to worry about most of the bills for about 6 months)

4. Finally, use your savings account as overdraft protection for your bill pay account, just as a precaution.

Some things to note:

– Call your Mortage company before doing this with your mortgage. Some will allow you to do this and some will not.

– Credit Card companies and Mortage companies will take the extra amounts you pay each week and put it towards your balance, so even if you loose your job you’re still going to need to make those minimum payments.